Your Comprehensive Employer Solution

The Advantage Program

The Advantage Program provides a comprehensive employment package that includes human resources, benefits, 401(k), workers’ compensation, and payroll. This all-in-one solution bolsters interactive engagement between your leadership team and valued staff with our experienced HR, benefits, and payroll subject matter experts.

Scroll down to read more or click the arrows to learn about our other solutions!

Payroll

Manage and Administer your Semi-Monthly Payroll

Streamline semi-monthly payroll oversight through strategic partnerships. We don't just manage - we shepherd your payroll process, providing insightful guidance every step of the way.

Compensation via Direct Deposit

Ensure seamless payments for your team through secure and efficient direct deposit services. By prioritizing employee convenience, we streamline the payroll experience, ensuring timely and accurate compensation.

Empower your Workforce with Unparalleled Accessibility

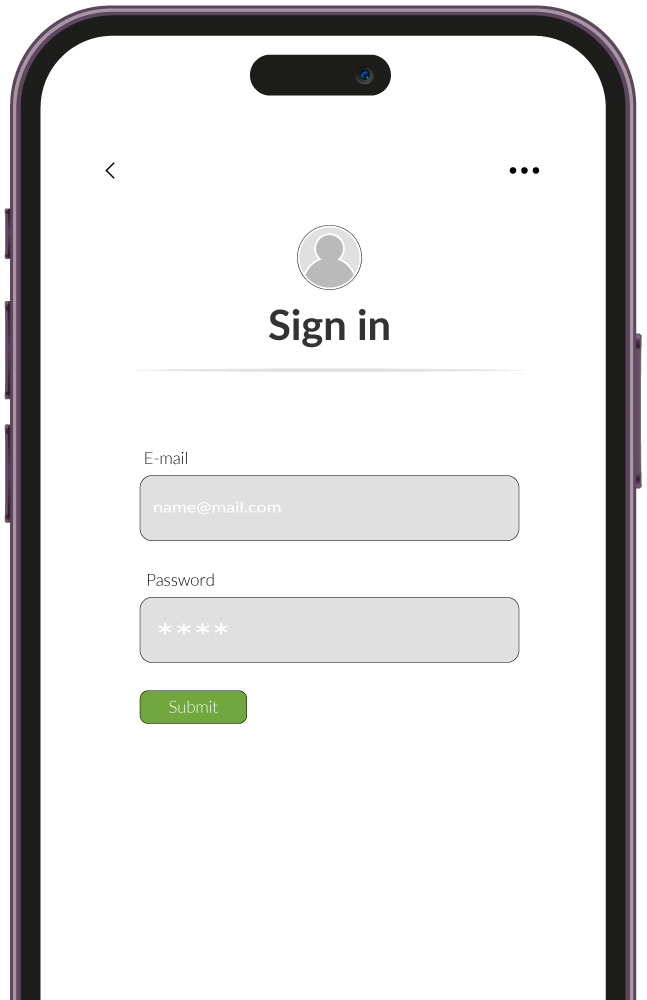

Our 24/7 online portal grants employees instant access to comprehensive payroll information, including check stubs and W2s. This transparent approach enhances employee satisfaction and fosters trust within your organization.

Centralized Liaison for Streamlined Communication

Simplify your payroll management with a dedicated single point of contact. Our personalized service ensures clear communication, quick resolution of queries, and a smooth, responsive experience for you and your team.

Program Offerings

Medical

- We offer three United HealthCare (UHC) medical plan offerings

- Each plan offering is part of the Choice Plus national PPO network

- Premiums for employees will be withheld from payroll on a pre-tax basis based on their election through Employee Navigator

- Each client contributes 90% towards employee only medical premiums

- Premium share options are available upon request

Dental

- We offer two dental plans through Delta Dental

- Premiums for employees will be withheld from payroll on a pre-tax basis based on their election through Employee Navigator

- Each client contributes 90% towards employee only dental premiums

- Dependent premium contributions are a per client decision

- Premium share options are available upon request

Group Term Life with AD&D

- $50,000 Term Life plan is an employer paid policy

Employee Assistance Program (EAP)

- This program is a confidential resource available at no cost to the employee or you, our client

401(k)

- Employees eligibility is the first of the month following 3 months of employment

- Matching contributions are made per pay period and are based on 100% of the first 3% deferral by the employee, then 50% of the next 2% deferred for a maximum employer match of 4% when the employee defers 5%

- After meeting eligibilty, employees can make deferral and investment selections and access or update their account

- Pre-tax & Roth Contributions

- Administered on Empower Retirement Platform

Vision

- Vision coverage is offered through Principal Vision and utilizes the VSP network

- As a voluntary benefit, vision premiums are 100% the employee responsibility and will be withheld from payroll on a pre-tax basis

Short Term Disability (STD)

- Plan benefit offering provides a 60% benefit percentage with the maximum benefit duration of 13 weeks

- Premiums are 100% paid by the employee as a post-tax withholding from payroll which are based on salary and age

Long Term Disability (LTD)

- LTD plan offering provides a 60% benefit percentage with the maximum benefit duration of 24 months

- Premiums are 100% paid by the employee as a post-tax withholding from payroll which are based on salary and age

Voluntary Term Life

- Employee Voluntary Term Life benefit maximum is $500,000 with the guarantee issue of $100,000

- Spouse guarantee issue is $30,000 with the maximum issue of $100,000

- Child Term Life is $25,000 guarantee and maximum benefit

- Premiums are 100% paid by the employee as a post-tax withholding from payroll which are based on each covered participant's age at enrollment

Flexible Spending Account (FSA) & Health Savings Account (HSA)

Allow your staff to lower their out-of-pocket health care costs by using untaxed dollars in an HSA and/or FSA to pay for deductibles, copayments, coinsurance, and other expenses

- Continuum Advantage utilizes Optum for FSA & HSA administration

- Eligibility for each plan will be reviewed with employees upon enrollment